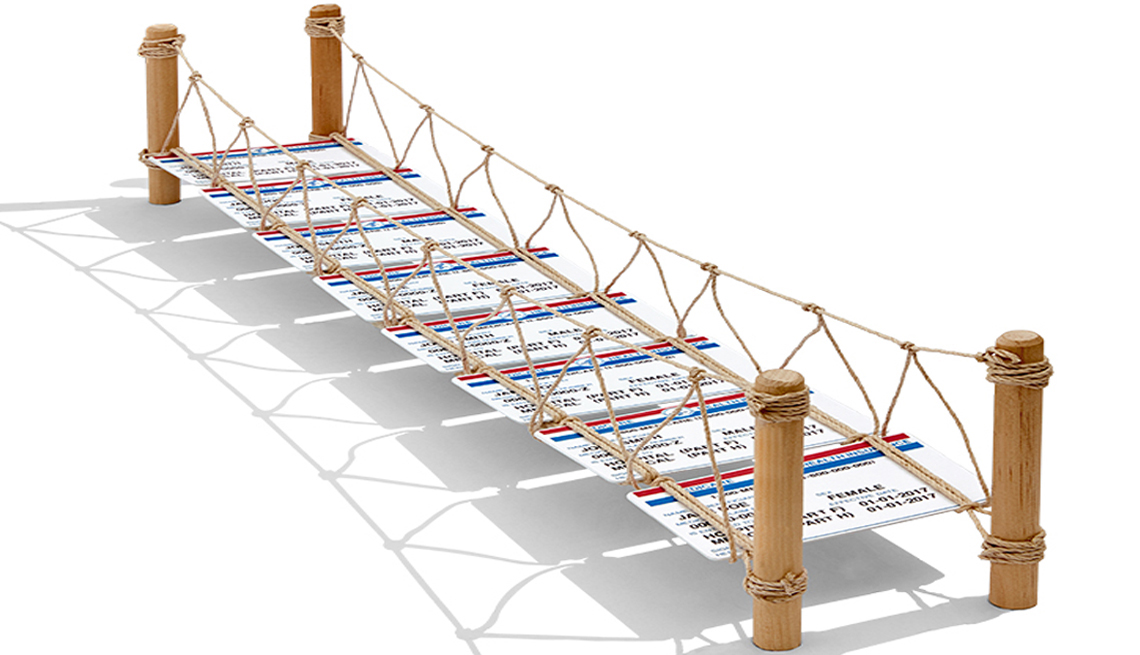

Medigap Plans Help Bridge Gap of Original Medicare Costs

Supplemental insurance will cover some deductibles and copays

En español | If you decide to enroll in original Medicare, one way you can help pay the extra costs the program doesn’t cover is to buy a supplemental — or Medigap — insurance policy.

Private insurers sell Medigap policies, but states and the federal government strictly regulate them. These plans are available for people enrolled in Medicare parts A and B, not for those who elect a Medicare Advantage plan. Medigap plans pay for costs such as deductibles and copays and other charges that Medicare doesn’t cover.

In 2010 the federal government standardized the types of Medigap plans, creating 10 options designated by A, B, C, D, F, G, K, L, M and N. In January 2020 two of the more comprehensive and popular plans, C and F, ceased to be available to people newly eligible for the program. That’s because in 2015, Congress decided to prohibit Medigap from covering the annual deductible for Part B, which pays for doctor visits and other outpatient services.

Of the 10 Medigap plans, C and F currently pay that deductible, which is $233 for 2022. The difference between plans C and F is that C does not cover the 15 percent in excess charges that doctors who don’t participate in Medicare are allowed to charge their patients; Plan F does.

Plan G is the closest in design to Plan F. It covers everything F does except the Part B deductible. And Plan D is the closest to Plan C. It covers everything C does except the Part B deductible and the excess charges that nonparticipating doctors are allowed to charge their Medicare patients.

It’s been widely reported that Plan F is “going away,” says Casey Schwarz, senior counsel for education and federal policy at the Medicare Rights Center. “That shorthand has caused a lot of panic. I think it’s really important to highlight that for people who have been enrolled in Plan C and Plan F, there is absolutely nothing changing."

But if you turned 65 after January 2020 or became disabled after the first of the year and want to buy a Medigap plan, you will not be able to enroll in either C or F. Current Medicare enrollees and anyone eligible for Medicare before Jan. 1, 2020, still have those plans to choose from.

If you think a Medigap policy might be right for you, here is some basic information you’ll need to know to make your decision.

The catch

And it’s a big one. When you first enroll in Medicare (during your seven-month initial enrollment period (IEP), insurers offering Medigap policies cannot deny you coverage or charge you more for any preexisting condition. After that, anything goes.

For example, if you don’t buy a Medigap policy during your IEP but decide a year later that you want one, insurers may be able to turn you down based on your health, or set prices higher because of a preexisting condition. How that works differs widely from state to state.

“What’s really important is that people find out what their rights are in their state,” Schwarz says.

The message: To be guaranteed stable, ongoing Medigap coverage for years to come, the time to buy is when you first enroll in Medicare.

The choices

To compare your Medigap plan choices, go to How to Compare Medigap Policies at Medicare.gov. Details are there on a single chart.

Don’t get confused by the way these policies are named. The Medigap policies’ letter designations have nothing to do with which Medicare program you chose.

Because the Medigap plans are standardized, an A or F plan sold by one insurer covers the same things as an A or F plan from another insurer. Medigap plans are consistent in all but three states: Massachusetts, Minnesota and Wisconsin have their own standard policies.

So how do the 10 policies differ? “Some are high deductible, some require higher cost-sharing, and some cover more costs,” says Mary Mealer, life and health manager at the Missouri Department of Insurance, Financial Institutions & Professional Registration. Consumers should “evaluate their individual situation as to what plan meets their needs and what they can afford.”

What to focus on

The government’s comparison chart shows 10 health care costs that a Medigap policy could cover. Some come into play more than others, so you should focus most on those big-ticket items. They include:

- Your 20 percent share of the cost of doctor visits

- Your 20 percent share of the cost of lab tests and other outpatient services

- The deductible for each time you are admitted to a hospital

- The coinsurance costs of hospital stays or stays in a skilled nursing facility after being in a hospital

There are other considerations, as well. While other plans cover 100 percent of Part B coinsurance, plans K and L have higher cost-sharing but also an out-of-pocket limit. Once you’ve paid that amount, they take care of 100 percent of covered services for the rest of the year. In 2022, the limit for Plan K is $6,620, and the limit for Plan L is $3,310. These limits increase each year, based on inflation.

Remember, Medigap does not cover prescription drugs or dental, vision or most other needs that original Medicare doesn’t cover.

What it will cost you

Nationwide, the average monthly premium for Medigap Plan G is $173 for a 65-year-old man and $156 for a 65-year-old woman, according to Weiss Ratings. High-deductible Plan G has a $2,490 deductible in 2022, and that premium averages about $54 a month for a 65-year-old man, and $49 a month for a 65-year-old woman. Premiums are based on three pricing systems and vary widely based on where you live.

- Attained-age rated. This premium is initially based on your current age but can rise as you get older.

- Community rated. The same monthly premium is charged to everyone who has this policy, regardless of age.

- Issue-age rated. This premium is based on your age when you first buy the policy. The younger you are, the lower the initial premium. Any premium increases in the future will not be based on your age.

Experts suggest that you ask a potential insurer which pricing system it uses before buying a Medigap policy. That way you’ll know whether to expect increases as you age.

Additional considerations

Mealer suggests that consumers contact their state’s insurance department before signing to make sure the agent and company selling the policy are licensed by the state and to find out that company’s complaint record. Each state has a State Health Insurance Assistance Program that can help you find this information.

And remember, changing a Medigap policy can be hard. Give the policy one last read to see if it covers not just your current needs but potential future needs.

Editor’s note: This story has been updated to include 2022 figures.

Dena Bunis covers Medicare, health care, health policy and Congress. She also writes the Medicare Made Easy column for the AARP Bulletin. An award-winning journalist, Bunis spent decades working for metropolitan daily newspapers, including as Washington bureau chief for the Orange County Register and as a health policy and workplace writer for Newsday.